State-backed fund Microfinance Ireland has opened its new €15 million Covid-19 fund to support small businesses through the current period of uncertainty and to protect jobs that have been impacted by the coronavirus pandemic here.

- Details

- Written by Sean

Micro businesses affected by Covid-19 can now apply for loans of up to €25,000.

- Details

- Written by Sean

Point of sale financing—the modern layaway that lets you pay for a new TV or dress in four installments instead of putting it on your credit card—has been rising steeply in popularity over the past two years, and the pandemic is propelling it to new heights. Australian company Afterpay, whose entire business is staked on the scheme, has sailed from a market valuation of $1 billion in 2018 to $18 billion today. Eight-year-old San Francisco startup Affirm is rumored to be planning an IPO that could fetch $10 billion. Now PayPal PYPL -0.2% is cramming into the space. Its new “Pay in 4” product will let you pay for any items that cost between $30 and $600 in four installments over six weeks.

Pay in 4’s fees make it different from other “buy now, pay later” products. Afterpay charges retailers roughly 5% of each transaction to offer its financing feature. It doesn’t charge interest to the consumer, but if you’re late on a payment, you’ll pay fees. Affirm also charges retailers transaction fees. But most of the time, it makes users pay interest of 10 - 30%, and it has no late fees. PayPal seems to be a lower-cost hybrid of the two. It won’t charge interest to the consumer or an additional fee to the retailer, but if you’re late on a payment, you’ll pay a fee of up to $10.

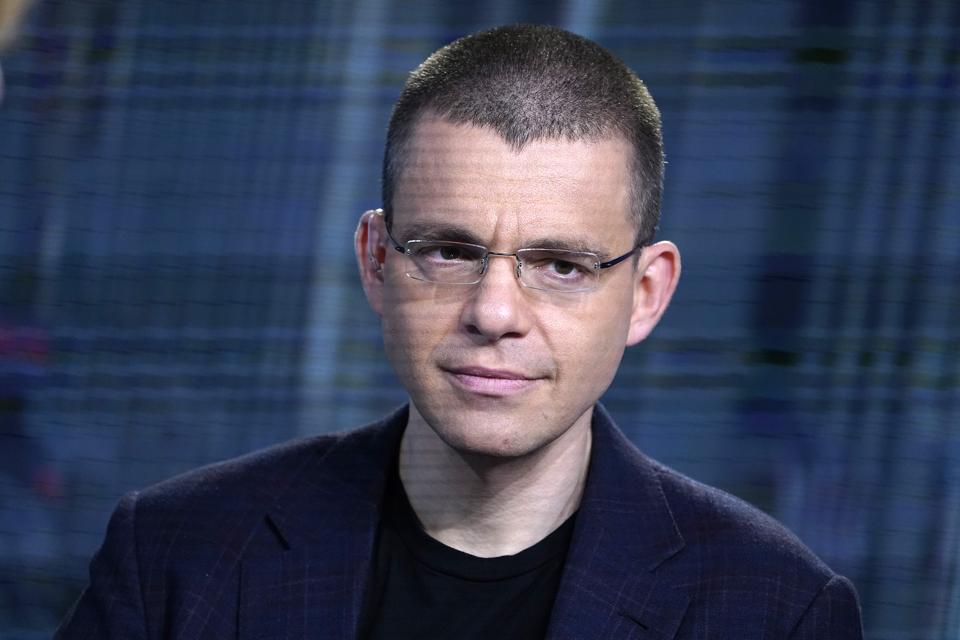

Serial entrepreneur Max Levchin started two of the three major players offering online point of sale financing in the U.S. He cofounded PayPal with Peter Thiel in 1999 and started Affirm in 2012.

PayPal coounder & Affirm CEO Max Levchin

John Lamparski/Getty ImagesPayPal can undercut the competition on fees because it already has a dominant, highly profitable payments network it can leverage. Eighty percent of the top 100 retailers in the U.S. let customers pay with PayPal, and nearly 70% of U.S. online buyers have PayPal accounts. PayPal charges retailers per-transaction fees of 2.9% plus $0.30, and in the second quarter, as Covid-19 made online purchases skyrocket, it saw record revenues of $5.3 billion and profits of $1.5 billion. Its stock has ballooned, adding $95 billion of market value over the past six months. In an economic environment where ecommerce is surging, “PayPal can grow 18-19% before it gets out of bed in the morning,” says Lisa Ellis, an analyst at MoffettNathanson.

Data from Afterpay and PayPal show that consumers spend more money—sometimes 20% more—when they’re offered point of sale financing options. When PayPal launches Pay in 4 this fall, it will likely see transaction sizes rise, and since it already earns 2.9% on each transaction, its fee revenue will rise in tandem.

The online point of sale financing market has millions of American customers so far. Afterpay, which expanded to the U.S. in 2018, has 5.6 million users. Affirm also says it has 5.6 million. Stockholm-based Klarna, 9 million, and Minneapolis-based Sezzle has at least one million.

Separate from Pay in 4, PayPal has been offering point of sale financing for more than a decade. It bought Baltimore startup Bill Me Later in 2008 and rebranded it as PayPal Credit in 2014. PayPal Credit lets consumers apply for a lump-sum line of credit and has millions of borrowers today. Like a credit card, it levies high interest rates of about 25% and requires monthly payments. These consumer loans can have a high risk of default, and PayPal doesn’t own most of them—it offloads the U.S. loans to Synchrony Bank. (In 2018, Synchrony acquired PayPal’s massive book of U.S. consumer loans for about $7 billion.)

This past spring, as the pandemic was spreading quickly and concerns spiked about consumers defaulting on loans, PayPal pumped the brakes on lending. “Like many installment lenders, they essentially halted extending loans in March or early April,” MoffettNathanson’s Ellis says. “Square SQ +2.3% did the same.” PayPal senior vice president Doug Bland says, “We took prudent, responsible action from a risk perspective.”

With Pay in 4, PayPal’s renewed push into lending is an indication the company is getting more aggressive in a volatile economy where many consumers have fared better than expected so far. Unlike PayPal Credit, PayPal will house these new loans on its own balance sheet. Bland says, “We’re incredibly comfortable in managing the credit risk of this.”

- Details

- Written by Sean

When you're considering accepting a business loan, it's important to develop a repayment plan. Here's how to calculate loan payments.

- Details

- Written by Sean

The COVID-19 pandemic has created a difficult and occasionally dire situation for small businesses.

- Details

- Written by Sean

At present, no business can be thought of which can run without money. Behind this, there is the need to invest money at every stage in the business.

- Details

- Written by Sean

Businesses with fewer than 10 workers can tap loans of up to €25,000 from a new €15 million fund launched by Microfinance Ireland (MFI) to aid them through the Covid-19 crisis .

SME Finance

If you are an SME or Sole-trader looking for finance to expand you business get in touch today.

We have the finance solution to meet your requirements.